Many investors have specific target dates associated with their goals — for example, investors approaching retirement may want to derisk a portion of their assets to fund their first few years of retirement. For these investors, predictability of returns becomes a primary factor.

The need for predictability

Over the past few years, fixed income investments have exhibited more volatility than investors may have expected, fueled by heightened inflation, rate hikes, rates cuts, tightening credit spreads and now increased geopolitical uncertainty.

Investors have expressed the need for outcome predictability when buying fixed income funds and ETFs, both in terms of expected returns and investment horizons. Both are primary features of individual bonds.

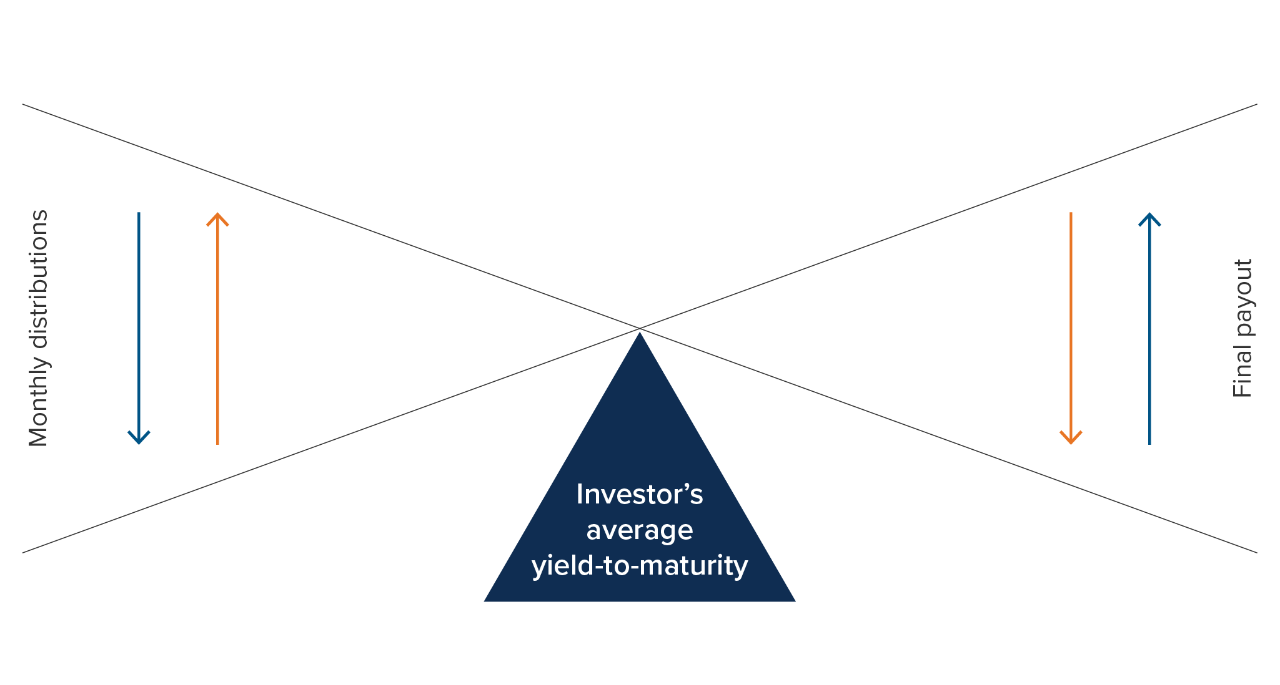

When buying a bond and holding it to maturity, investors refer to the yield to maturity (YTM), as an indication of the expected average annual rate of return at the time of purchase, if held to maturity. The YTM will annualize the future interest income, plus or minus the gain/loss expected on the bonds at maturity, assuming no default and the bond is held to maturity.

Yield to maturity dynamics

Increases (or decreases) in monthly distributions are usually counterbalanced by a decrease (or increase) in the maturity value, resulting in a relatively constant anticipated YTM.

One strategy often used by bond holders is a “ladder”, which consists in holding bonds at different maturities in the portfolio and reinvesting the proceeds of maturing bonds into new ones at the longest maturity in order to constantly have rolling exposure to the desired maturities.

An innovative solution

Mackenzie Target Maturity Bond Funds and ETFs are the first to offer exposure to North American investment grade corporate bonds with two- and four-year maturities.

These solutions are designed to provide investors with a combination of features associated with bonds, funds and ETFs:

- A predictable outcome when held to maturity, similar to holding a bond.

- Intraday liquidity (ETF).

- Diversification benefits from holding bonds from different issuers.

- Regular monthly income.

- Active management and potential tax efficiency.1

Benefits of target maturity bond ETFs and funds

|

Target maturity bond funds |

Individual bonds |

Traditional bond ETFs |

Traditional mutual funds |

GICs |

Scalable across client accounts |

✔

|

|

✔

|

✔

|

✔

|

Diversified portfolio |

✔

|

|

✔

|

✔

|

|

Monthly distributions |

✔

|

|

✔

|

✔

|

|

Target potential performance at maturity known in advance |

✔

|

✔

|

|

|

✔

|

Duration declines over time |

✔

|

✔

|

|

|

|

Fixed maturity |

✔

|

✔

|

|

|

✔

|

Transparent intraday prices |

✔ |

✔

|

✔

|

|

|

How does it work?

Mackenzie Target Maturity Bond Funds and ETFs will offer exposure to an actively managed diversified portfolio seeking high total return potential through discounted and diversified bond exposure.

As the bonds in the portfolio mature, the portfolio will hold the proceeds as cash and cash equivalents until the fund/ETF reaches its target maturity date.

When all the bonds have matured, the fund/ETF will delist and pay out a final distribution to unitholders, similar to the return of principal when a bond matures.

Portfolio Composition (%)

Addressing investors’ needs :

- Match expected liquidity needs with pre-set investment horizons for goal-based investors.

- Capital preservation by minimizing the risk of daily mark-to-market losses.

- Income and yield through monthly distributions.

- Flexibility and liquidity if capital is needed before maturity.

Contact your Sales Representative to learn more about the Mackenzie Target Maturity Bond Funds and ETFs, and the Mackenzie Fixed Income Team.

1 Bonds trading at a discount to their par value may offer a tax advantage for investors in non-registered accounts over cash, GICs and individual bonds (purchased at their par value) as a larger portion of its total return may be derived from capital gains which are subject to lower tax rates than interest income.

Commissions, management fees, brokerage fees and expenses all may be associated with Mutual Funds and Exchange Traded Funds. Please read the prospectus before investing. Mutual Funds and Exchange Traded Funds are not guaranteed, their values change frequently and past performance may not be repeated.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.