Over the recent years, AAA collateralized loan obligations (CLOs) have gained popularity in the markets. At $1.3 trillion (USD)1 the CLO market is now too big for investors to ignore. This asset class has historically offered a compelling combination of above-average yield, strong credit fundamentals and diversification benefits. Nevertheless, many investors may still be hesitant because of their apparent complexity and confusion with other, more risky securitized products that led to the 2008 Great Financial Crisis. Yet AAA CLOs offer an attractive investment opportunity that is well worth the effort required to understand them.

CLO structuring

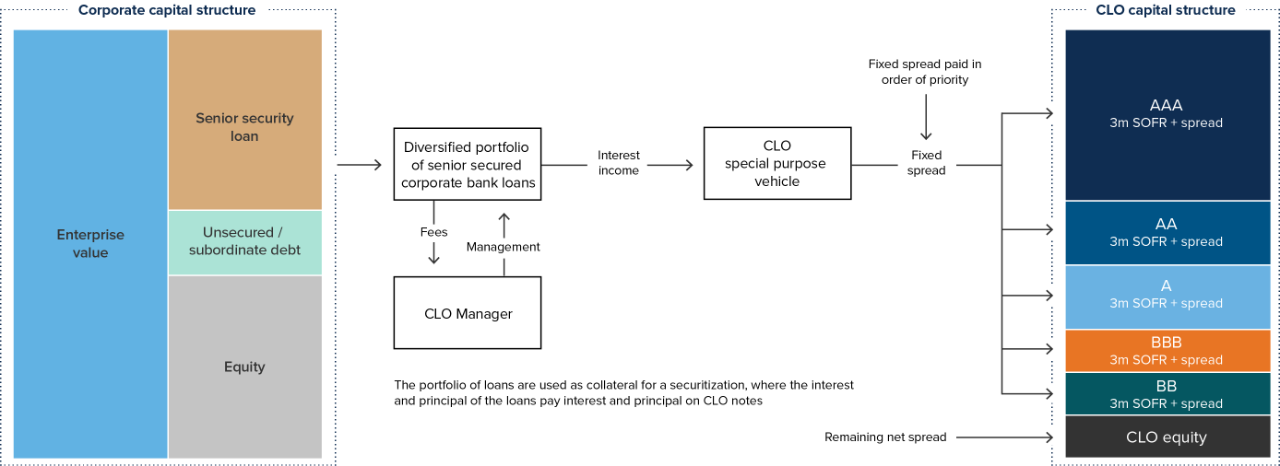

CLOs are structured financial products that pool together loans, typically those made to businesses, and then divide them into tranches based on the risk and return profile.

The structure of CLOs is built to mitigate default risk by providing multiple layers of protection. The equity tranche absorbs any initial losses, followed by mezzanine tranches, ensuring that the AAA tranche remains protected unless all other layers fail.

AAA CLO benefits

Unlike other securitized investments, CLOs are actively managed (by the CLO manager) pools of senior secured loans (typically first lien on assets).

Benefits |

||

Attractive coupons to boost the portfolio yield |

Strong credit ratings to enhance the portfolio’s quality |

Low correlation with the other assets to spread the portfolio’s risk |

|

|

|

Not all securitized investments are created equal

- Securitized products are bonds that are backed by pools of different types of loans (mortgages, corporate/sovereign loans, consumer credit, project finance, lease/trade receivables, etc.).

- The loans are structured into interest-bearing securities and then sold in the bond market.

- The income generated for the securitization is created from the loan on the assets and passed through tranches to the holder of the securities.

- Each tranche that is higher in the capital structure has a more senior right to the cash flows and principal payments of the underlying loans than tranches below it.

- The securitized investments are offered in a wide range of structuring and exposures:

- Mortgage-backed securities (MBS): the underlying assets are mortgages, either residential (RMBS) or commercial (CMBS).

- Asset-backed securities (ABS): securities backed by a pool of financial assets, such as loans, leases, credit card debt, royalties, or receivables.

- Collateralized debt obligations (CDOs): securitizations of a pool of assets (often non-mortgage), where the underlying assets are loans or other debt instruments.

- Collateralized loan obligations (CLOs): securitized and actively managed portfolios of secured loans, issuing bonds with varying priorities and risks based on the income from those loans.

CDOs versus CLOs

While both CDOs and CLOs are securitized products that, on the surface, share many structural similarities, these similarities can cause confusion among investors.

CLOs stand apart from other types of structured credit due to the types of assets they invest in and structural risk protections.

CDOs |

CLOs |

|

Underlying assets |

Typically include a variety of debt instruments such as bonds, mortgages (including subprime mortgages) or even other CDOs. |

Focus exclusively on leveraged loans, which are first-lien senior secured corporate loans. |

Managed |

Static pool |

Actively managed |

Risk and return profiles |

Often had higher risk due to the inclusion of subprime mortgages and other lower-quality assets, which contributed to their poor performance during the global financial crisis. |

Have built-in risk protections and invest in higher-quality assets, resulting in better performance even during periods of market stress. |

Transparency |

Were often opaque, making it difficult for investors to understand the underlying assets and risks. |

Are generally more transparent, allowing investors to look through to the underlying loans and perform credit analysis. |

AAA CLOs: Two layers of risk mitigation

Built-in risk protections

The CLO issuer/manager typically implement a set of rules and tests to ensure the effectiveness of the subordination process.

- Overcollateralization tests seek to ensure the principal value of the bank loan collateral pool exceeds the outstanding principal of the CLO debt tranches. If the bank loan collateral’s principal value declines below the test trigger value, cash that otherwise would have been distributed to the equity and junior CLO tranches will be used to pay down senior debt tranche investors instead.

- Interest coverage tests aim to ensure the adequacy of cash collected from the bank loan collateral to pay CLO tranche interest. If collateral collections decline below the test trigger value, cash that otherwise would have been distributed to the equity and junior CLO tranches will be used to pay down senior debt tranche investors instead.

- Collateral concentration limits seek to limit risk in the bank loan collateral pool and protect CLO investors from loss. Typically the limits include requirements for industry diversification in the underlying pool of bank loans and exposure to non-senior secured loans and single obligors.

- Borrower diversification seeks to mitigate risk by diversifying the pool of loans across 150-450 distinct borrowers in 20-30 industries, with a small percentage of the assets (1% for example) invested in the loans of any single borrower.

- Borrower size requirements often restrict managers from purchasing loans to small companies, whose trading liquidity is low.

The Mackenzie AAA CLO ETF leverages the expertise of the Mackenzie Fixed Income Team in managing floating rate loan ETFs and mutual funds in Canada.

Contact your Sales Representative to learn more about the Mackenzie AAA CLO ETF and the Mackenzie Fixed Income Team.

1 As at December 2024.

Commissions, management fees, brokerage fees and expenses may all be associated with Exchange Traded Funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Exchange Traded Funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

The payment of distributions is not guaranteed and may fluctuate. The payment of distributions should not be confused with a fund’s performance, rate of return or yield. If distributions paid by the fund are greater than the performance of the fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a fund, and income and dividends earned by a fund are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This article may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of March 31, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.