Highlights:

- For all the polarizing language, the Liberal and Conservative economic platforms were similar.

- Expect expanded deficits, with stimulus spending coming in the next few months.

- Trade negotiations will be complicated in a minority government context, and we don’t expect additional counter-tariffs in coming months.

- The Liberal platform takes a few stabs at boosting productivity, but evidently no major policy changes to reverse sluggish long-term growth.

Canadian elections rarely swing financial markets. 2025 has been no exception. Investors mostly shrugged off the odds-on election of a Liberal government before April 28th.

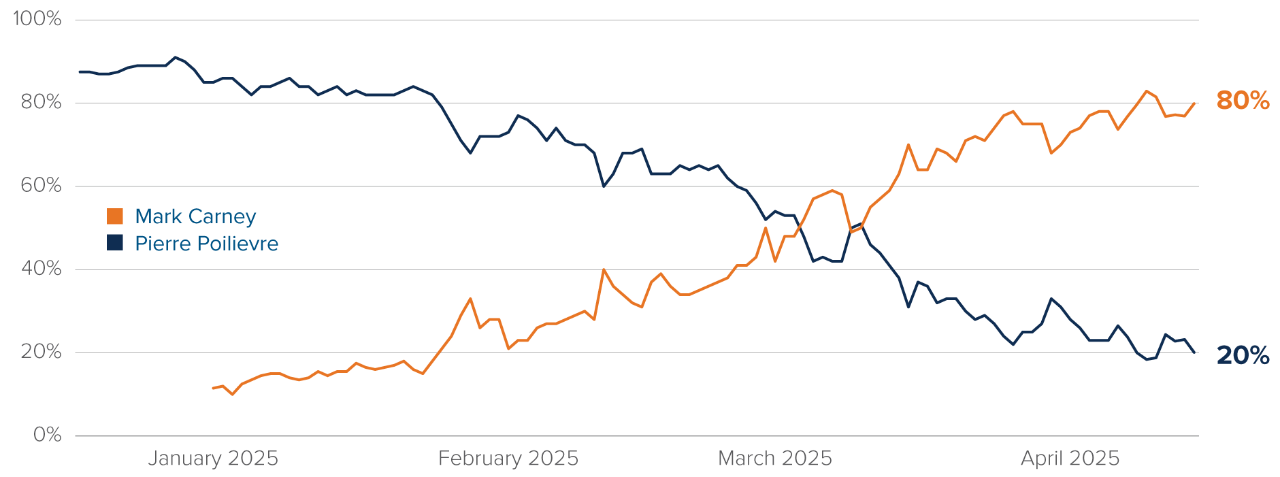

In part, the weak market reaction reflects a lack of surprise in the election results. Election night saw plenty of surprises in the details. But the outcome was broadly in line with pre-election polls. Polymarket, an online betting market, placed the odds of a Liberal win at around 80% in the days leading up to April 28. But the tepid reaction is also reflective of Mark Carney and Pierre Poilievre being similar candidates on the economic policy front: expanded deficits, personal income tax cuts, tough stance against US tariffs, trimming of immigration rates, and relaxing of constraints on the energy sector.

A comeback, but not an election-day surprise

Polymarket odds for next Prime Minister

Source: Polymarket.

Source: Polymarket.

Per our analysis, carrying out Prime Minister Carney’s platform will require an average deficit of ~1.95% of GDP over the next four years. In its November 2024 Fall Economic Update, the Trudeau government forecasted an average deficit of 1.1% of GDP over that same period. Our expectation of deficit expansion between then and now reflects both fresh spending from the Carney platform and a lower GDP growth, given Trump’s decision to rattle the world economy in the interim. We would also have forecasted sizable deficit expansion under a Poilievre government. Realistically, implementing the Conservative platform would have required a deficit of ~1.35% of GDP over the next four years.

Deficits expand in every scenario

Estimate of “realistic” deficit from platforms, avg. % of GDP/year over next 4 years

Source: Conservative Party, Liberal Party, author’s calculations. The deficit estimates adjust for the deterioration in nominal GDP growth expectations since November 2024, vague “plugs” on the revenue side of party platforms, and remove the effects of dynamic scoring, in line with the methodology of the Parliamentary Budget Office.

A Carney government could be a driver of Canadian dollar appreciation, at the margin. As long as it doesn’t trigger fears of long-term fiscal sustainability, fresh net spending tends to strengthen a country’s exchange rate. Canada’s public debt path is ugly, but still manageable. Global investors will likely give benefit of the doubt to Carney as steward of Canadian finances, given his pedigree.

The extra ~0.85%/year in deficit spending should meaningfully boost short-term GDP growth. A chunk of the new net spending is immediately implementable and should have high-impact: cutting the first-bracket income tax rate, slashing building development charges and Guaranteed Income Supplement for first-time home buyers, and boosting GIS for seniors. If the Liberals want to win over the Bloc on more contentious policy issues, they could adopt their banner policy of boosting Old Age Security, costing an extra $15 billion over four years.

Forecasters waking up to the Trump risk

Average forecaster’s estimate for Canadian GDP growth in 2025 and 2026 , Consensus Economics

Source: Consensus Economics.

Source: Consensus Economics.

A few years ago the Bank of Canada (BoC) was blindsided by the $30 billion fresh spending announced in Budget 2022, which was a surprise tailwind to already-toasty inflation. This time around, the BoC could be wary of aggressively lowering interest rates ahead of a surge in federal government spending that might reach $100 billion over four years, if Trump barrels ahead with his trade war on the world.

We expect the Canadian dollar to underperform over the next few months. As a procyclical currency, CAD could be dragged down by a global economic slowdown. But it would have been on even thinner ground absent the expected upcoming federal stimulus.

How aggressive will Prime Minister Carney be in confronting President Trump? In the early stages of the campaign, Carney proved combative on the trade front. From media leaks, we know he even entertained a controversial export ban on Canadian oil, one of Canada’s most salient trump cards.

However, since April 2, when Canada was either forgotten, ignored, or willingly excluded from US reciprocal tariffs, Prime Minister Carney has been much more balanced in his tone. Canada is still impacted by a 25% tariff on non-energy goods, 10% tariff on energy, and sectoral tariffs on steel, aluminum, and autos, however exports to the US that are compliant with the Canada-US-Mexico free trade agreement (CUSMA) are exempted. As a result, the effective rate on Canadian exports to the US is around 6%, which is one of the lowest rates in the world. Plus, another 2% of Canadian exports could easily achieve compliance. In our view it’s unlikely that Carney would impose additional counter-tariffs on the US at this point. The existing counter-tariffs on autos, steel, aluminum and $30 billion of ad-hoc manufacturing imports from the US will only add an estimated 0.2%-0.3% to Canadian inflation over the next year.

From worse to best

Tariff rates announced by Trump as of Liberation Day

Source: Bloomberg. The China tariff number includes tariffs from the First Trump administration, and exemptions for electronic products. The Canada number is our estimate based on approximate USMCA compliance today, and in one year.

Canada’s economy faces a tumultuous 2025, but the true challenge lies in the longer term outlook. The Carney platform makes a few stabs at reversing the productivity decline afflicting the Canadian economy. Breathing room for energy projects will help, given that the energy sector has Canada’s highest productivity rate. A few policy measures are aimed at boosting Research & Development at Canadian companies. “Patent boxes” will lower corporate tax rates on income emanating from intellectual property. Immediate expensing of costs should make the calculus on productive investments more favorable. However, it appears that we won’t be getting any of the big-ticket policies that could have turned the ship around, such as corporate tax rate cuts, arm-twisting cities to expedite housing construction, and clear plans to trim excess program spending.

Economic priority #1: reversing the decline

GDP per capita, 25-54 years old

Source: Bloomberg.

Source: Bloomberg.

The new government plans to maintain Trudeau’s immigration cap, the most under-discussed economic issue. We forecast the Canadian population to decline over the next 12-18 months, a sharp pivot from the galloping growth of the past few years. Everything else being equal, in Canada’s economic context, slowing immigration means cooler growth, and a lower neutral interest rate (the rate above which BoC interest rates slow the Canadian economy).

Declining immigration: the most under-discussed economic force

Migration (% of population, sum of last four quarters)

Source: Bloomberg. The dotted lines represent forecasts by the author.

Source: Bloomberg. The dotted lines represent forecasts by the author.

As a central banker, Carney was an innovative and steady-handed policy-maker. Now he may find that setting Canada’s interest rate was one thing, but as elected Prime Minister, wrestling a half-frozen, tariff-strangled, productivity-challenged economy back to life is quite a bit more complex. Achieving Canada’s main economic goals — avoiding a recession in 2025, diversifying export markets, reversing the productivity decline, improving access to housing, and slashing interprovincial trade barriers — will take both an economics degree and a deft geopolitical touch. For the sake of economists everywhere, let’s hope our reputations get a nice boost over the next four years!

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. The content of this material (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. This material contains forward-looking information which reflects our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of April 29, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.